Hum by Verizon

Utilizing data to impact positive change for struggling product web site

Hum by Verizon is a connected car platform that delivers connectivity, insights and intelligence to car owners via a mobile app. The system enables anyone who owns a car built after 1996 (with an OBDII port) to track the car’s location, set boundaries for drivers (think newly licensed teen drivers) and provide in-car wi-fi (queue, the “and more!”).

Rokkan won the Hum account in 2017, owning the product and brand’s digital channels and campaigns, all aimed at converting prospective buyers via the web experience.

Six months into the effort, it was clear that the web experience wasn’t delivering with on-site engagement and conversions having never taken off.

At this point, I was asked to join the account, take the experience strategy reigns and see if I could impact positive change for product adoption.

Deliveries

- Data and Analytics Research

- Product & experience strategy

- Design optimizations against conversion journey

Hum by Verizon

Experience Strategy

Data Driven Design

Responsive Web

Experience Design Director

5 months: 2018

Joining the team. Evaluating site performance.

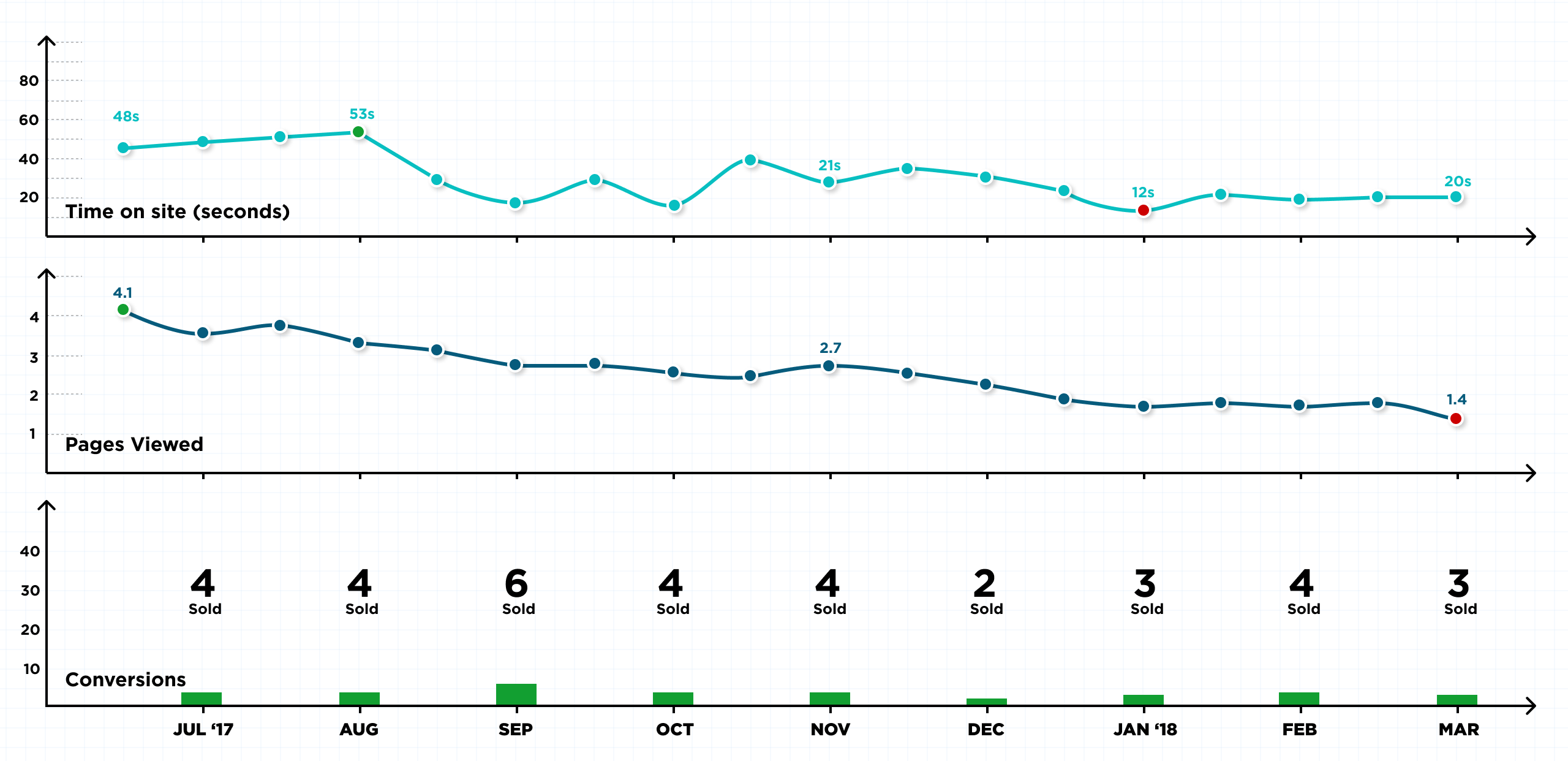

First, I needed to take a look at the historic data. Nominal daily traffic to the site averaged from 375 to 450 visitors with traffic initially spiking up to 3500 per day with campaign launches combined with ad referrals — campaigns occurred monthly, many centered around major holidays.

In all, the website was only converting 2-6 visitors a month into Hum owners. Meanwhile, the device was selling around 125 devices per month (abysmal, but more on that later).

Traffic, even during campaign periods, was far from impressive, suggesting that product awareness (and value) was fairly poor. After all, even in 2017, Apple CarPlay and Android Auto were delivering connected car systems that did everything Hum could do, and, at no extra cost beyond owning a phone and compatible car.

While the market space for Hum was somewhat limited, the device was somehow making its way into customer’s hands as a consistent pace.

The most baffling figure was that online sales were accounting for only 1-6% of monthly sales. Why?!!

What was causing low conversion on-site?

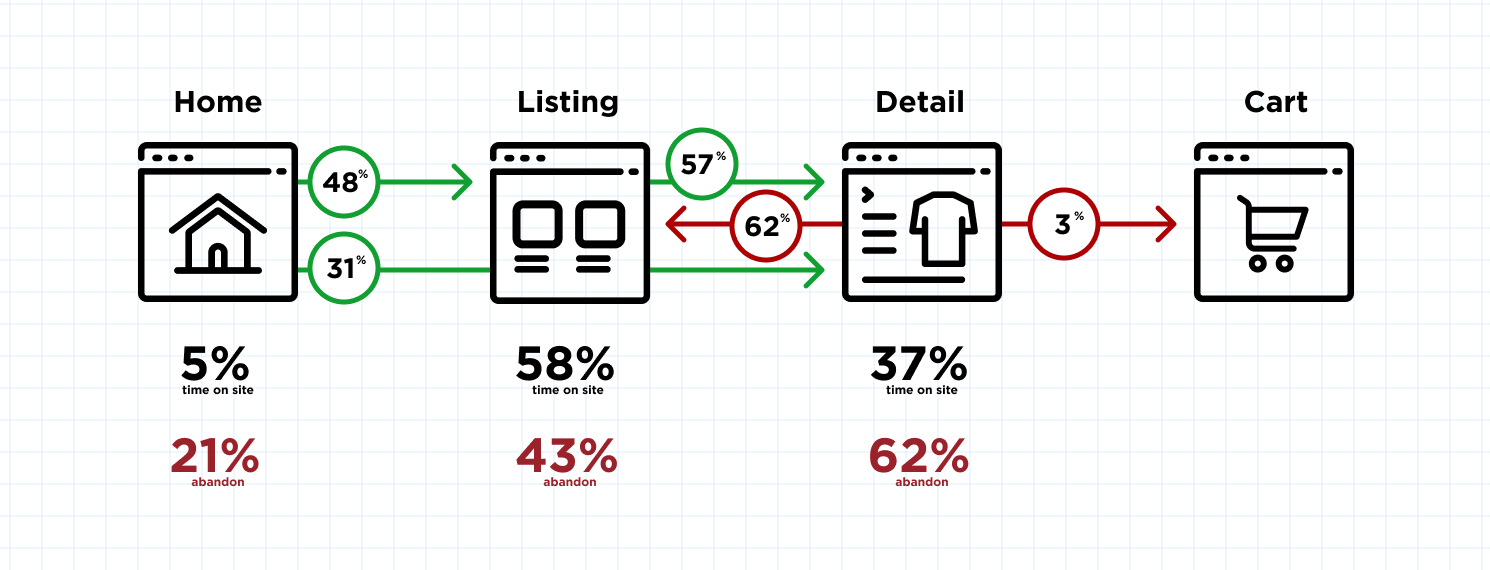

Digging deeper into site data — in order to understand why the site was not converting — revealed a troubling churn.

Users were spending a great deal of time traversing the product listing and product detail pages, with very few making it out of the cycle to create a shopping cart, let alone complete a purchase.

Figures above represent the bi-weekly average (our reporting cadence) from the 6-month period between July 2017 and January 2018.

The site was essentially failing mid-funnel, and failing hard! While campaign efforts were building some interest and intrigue in the product, potential customers were coming to the site to learn exactly what Hum was.

Navigation patterns going back and forth between the product listings and product detail pages strongly suggested that the site was failing to educate users and further failing to compel users to purchase, only 3% of total traffic that made it to a product detail page added to cart.

Users were just not compelled by the site to consider Hum as a worthwhile product.

The site left customer’s confused

Churn between the listing and detail pages + high abandonment rates (on those pages) suggested that customers were not getting the information they needed to make a confident purchase decision.

Content in chaos

The site also failed to properly organize features and price points for Hum, amplifying the confusion customers faced as they were hunting for relevant information on the product listing and product detail pages.

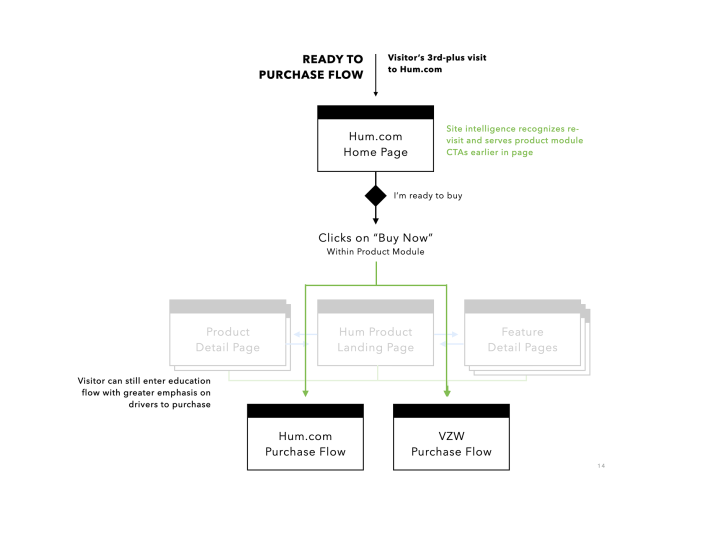

Blindness to revisits

Data showed that only 3% of customers entered the cart/checkout flow, BUT, that there was a 22% return visitor rate.

The site, however, was not architected to take advantage of those return visitors’ needs.

The solution? Clarifying product and the journey across the funnel.

The site had essentially been organized and designed without proper UX input. Pages were essentially crafted in silos, with little consideration given to customers who would be arriving knowing next to nothing about Hum or connected car devices.

If they didn’t know what Hum could do for them, there was no way they could confidently make a decision to purpose.

At this point, I was ready to diagnose and propose:

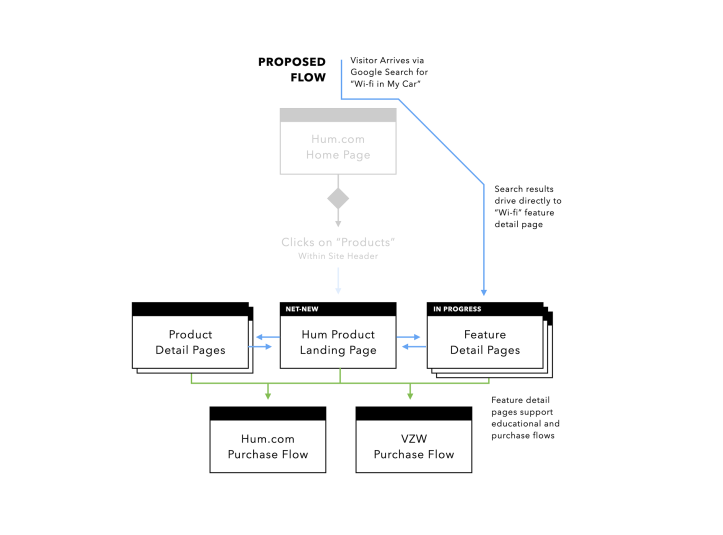

Foster an education journey

The site needed to instill confidence in Hum’s product purpose as well as the product cost (inclusive of the monthly data subscription).

I proposed that we needed to add product and feature pages that highlighted Hum’s use cases.

Organize information, eliminate confusion

Next, we needed to reign in the chaotic nature which the site’s content had been designed and written around, especially around pricing structure.

The outcome was to implement clear and simple storybuilding down the page and comparison tables for features and prices.

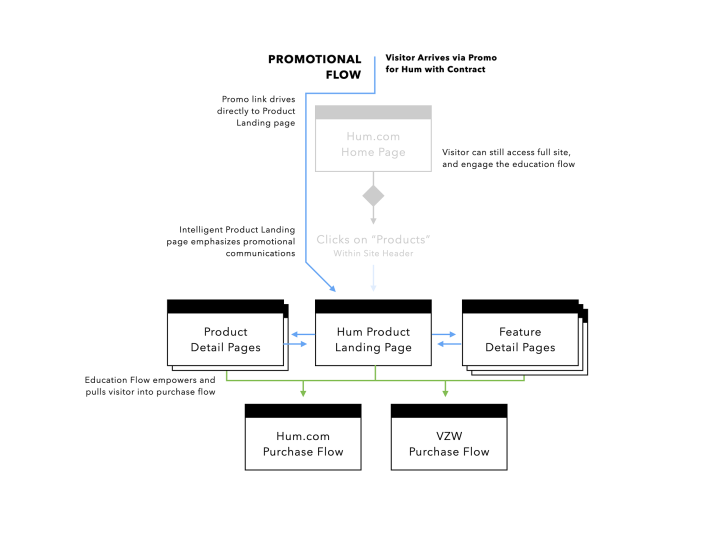

Add site intelligence

Finally, I proposed that we begin to augment the site experience when we were able to recognize customer’s who were returning.

While first-time visitors were oriented and educated to Hum, revisits were to begin leaning heavily on value proposition and use cases.

Below you can see proposed user flows and net new site elements that delivered on the solutions above:

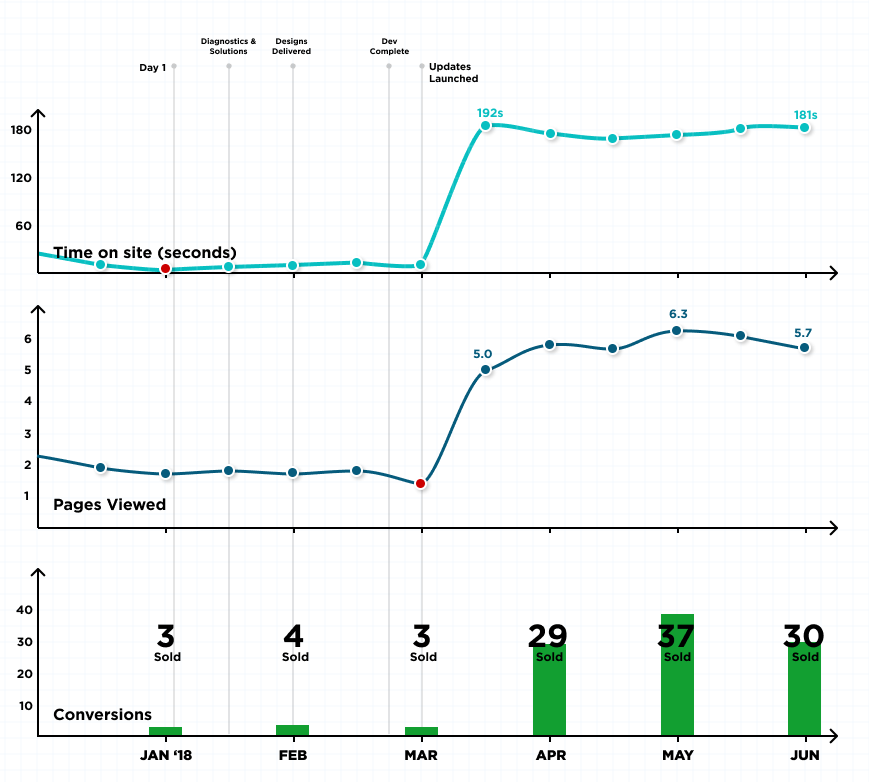

The total process — from joining the team in January 2018 through solutions being launched to public — took 8 weeks. Post-launch of our updated solutions, I stayed on board the account for another 3 months, overseeing performance deltas and reinforcing our strategic solutions.

Once launched, the website saw immediate performance improvements:

What we delivered

Outcomes

-

3m 05s

Time on siteAverage time on site increased from an average of 25 seconds to 3 minutes, showing the changes to site structure and content were keeping users engaged for much longer.

-

5.7

Page viewsPage views also increased during this period, up from an average of 2.3, further confirming ux improvements were having a positive impact.

-

↑1067%

Customers entering lower funnelIn the month following the site update, 52 customers decided to pursue purchase on-site, lifting conversion into the lower funnel to 7.8% of traffic reaching product detail pages.

Further 61% conversion rate for users who entered the lower funnel with 32 purchases completed.

-

↑960%

(Monthly avg.) Increase in online salesAdmittedly, still an ugly online sales figure, averaging 32 sales per month.

Sales share for online sales increased to 28% (32 of 115 sales/month avg). People just didn’t have a need for Hum; many who purchased, regretted it.

Director’s Note

Did retail sales practices impact customer trust?

Remember how online sales were accounting for only 1-6% of monthly sales? Retail sales at Verizon stores accounted for the rest; but, those sales may have hurt the brand and product experience more than it helped.

Here’s why.

Pushy sales at retail

as an in-store add-on

The overwhelming majority of Hum sales came from Verizon retail, where Hum was sold on a commissions basis.

While selling mobile subscriptions and upgrades, staff would essentially push Hum on customers as an add-on product and mobile data line…

Sell what? To Who?

…However, retail staff, having not been trained on Hum’s value proposition and features could not effectively promote the product to potential customers who could benefit from the platform:

Owners of older cars that did not support CarPlay and Android Auto.

“What exactly is this thing I bought?”

Customers who ended up with Hum were rightly confused, and ultimately upset.

Owners of new cars found the product outclassed by Apple/Android, and owners of older cars didn’t understand why they were paying for an extra mobile data subscription.

In fact, in a October 2017 survey, 65% believed that they had been taken advantage of by the sales staff with misleading sales information.

True remorse. Low (True) Convesion

Device activation rates further reflected buyer remorse.

- 36% of monthly app installs produced active Hum users (45 of 125 avg. est. net sales/month).

- Only 28% of those installs yielded active users.

- The return rate for the device between July and Dec 2017 was as high as 44%.

Similar Projects